When to Invest in Real Estate (Spoiler: It’s Right Now)

If you're here you’ve likely been contemplating the goal of building a real estate investment portfolio, yet something is holding you back from taking that crucial first step. Let us ignite your motivation by reminding you that every day without ownership is another missed opportunity to maximize your profits.

The time to invest in real estate is now.

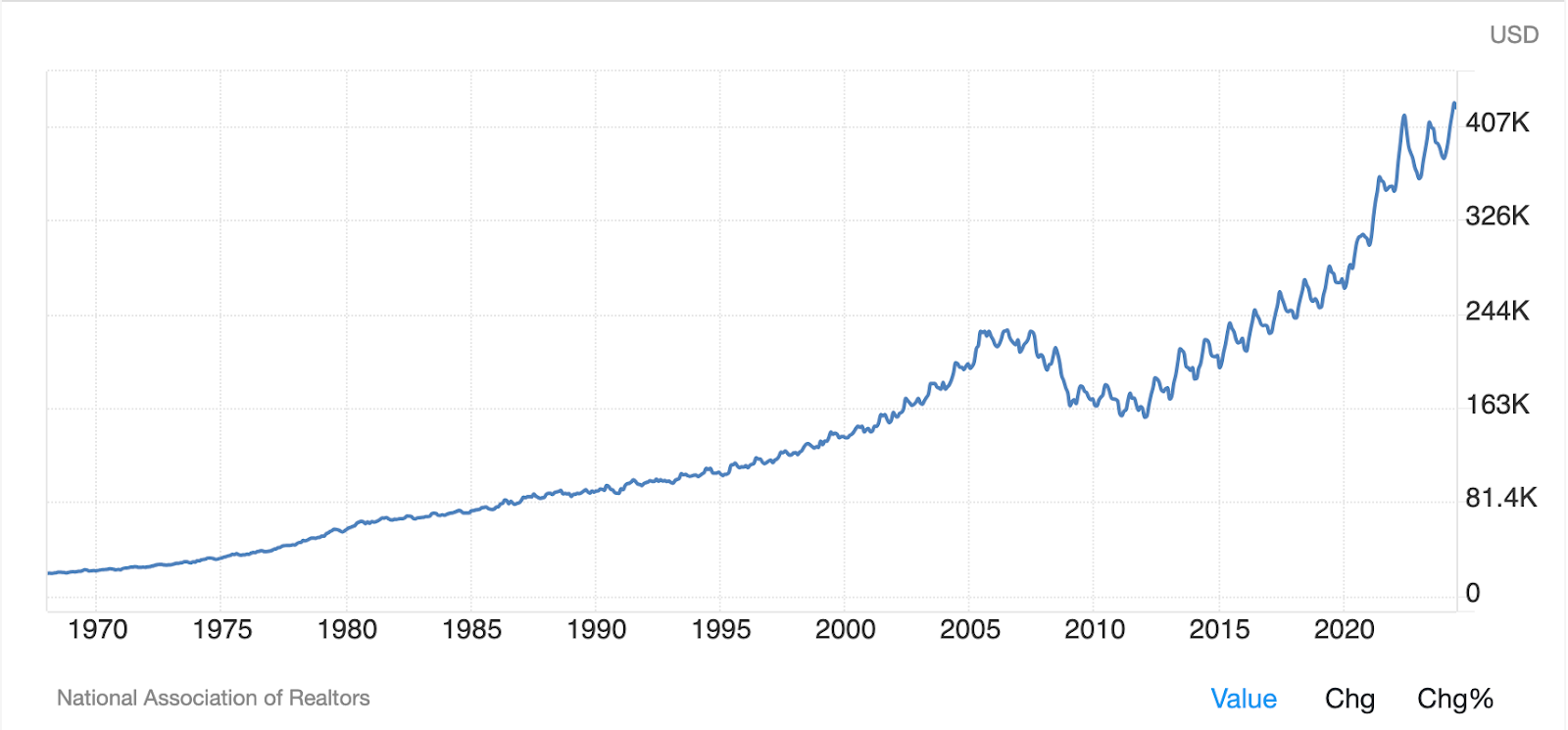

Historical data proves that property values continue appreciating over time. Below is a graph from the National Association of Realtors that reflects the median existing-home price for all housing types in the US.

Similar to the stock market, “timing the market” is not an effective strategy. While the housing market tends to react more slowly and offer clearer indicators of upcoming cycles, many investors prematurely declared a “peak” throughout the COVID surge from 2020 to 2022, yet the market continues to rise.

Date the rate, marry the asset.

Quit waiting around for the mortgage rates to drop. We understand the desire to lock in the best rate, but it’s important to remember that mortgage rates are fleeting. Refinancing is always available, however the property you’re interested in may not be. Secure that asset while you can and keep an eye on interest rate trends so that you can jump on a lower rate when it becomes available.

“Buying real estate is not only the best way, the quickest way, the safest way, but the only way to become wealthy.”

-Marshall Field

Real estate investing and retirement planning can go hand in hand. The earlier you get in the game, the sooner you can enjoy the rewards of a passive income stream. Investment properties are often acquired with a mortgage, which customarily takes 20 to 30 years to pay off. Ideally, you’ll own your properties outright by the time you retire, empowering you to take full advantage of your golden years. Prime earning years start in your thirties – don’t delay!

Leverage the leverage.

Don’t be afraid of using leverage, especially if you’re under 50. Often, leveraging can work to your advantage and offer benefits you wouldn’t have access to if you solely relied on ready cash at the time of your purchase. Leveraging can be the key difference between acquiring real estate and missing out on opportunities.

When is leveraging the ideal approach?

Consider spreading your investable dollars across multiple properties rather than allocating all of your funds to purchase one property in cash. By starting with a 25% down payment and financing the remaining 75%, you can give your portfolio a significant boost right from the start.

If you’re looking into a fixer upper, it's wise to set aside funds for renovations, as financing for development and construction can be challenging. By opting for a smaller down payment and a larger mortgage, you’ll have access to cash that can be reserved for restoration expenses.

When the cash flow of your asset covers your debt, your property can effectively “afford” a mortgage. This puts money back in your pocket, enabling you to reinvest and expand your portfolio.

Throughout your real estate investing journey, there may be times when you encounter an unbeatable opportunity to acquire an asset at a significant discount, but don’t have the cash readily available. While this approach carries more risk and requires a solid plan, leveraging can enable you to acquire the asset now and refinance into more stable debt later.

Whenever and however you opt to use leverage, be sure to align it with your personal risk tolerance. While there are certainly effective approaches to optimizing debt, it’s important to remember that leverage can also result in losses if real estate values decline. Always keep a close eye on your debt to asset ratio.

The power of an offer.

The most significant number in real estate investment that you have control over is your purchase price. You hold the power to make an offer, and that often means bidding below the asking price. The keys to success are patience and discipline. Avoid the temptation of speculation; instead, focus on the numbers in front of you today. There are always great deals to be found, but it’s essential to take your time and remain consistent in your search to find the opportunities that are best for you.

“Beware the fury of a patient man”

-John Dryden

Today is the day to lay the foundation for your future. Waiting for the "perfect" moment can lead to missed opportunities and stagnant progress. By taking action now, you can start building wealth, generating passive income, and securing your financial future. Real estate offers unique advantages, from leveraging your investments to capitalizing on market trends, and each moment spent hesitating is a chance lost. Embrace the journey, stay informed, and take that crucial first step—your future self will thank you for it!